Diversity in Asia – every challenge comes with an opportunity

- Like

- Digg

- Del

- Tumblr

- VKontakte

- Buffer

- Love This

- Odnoklassniki

- Meneame

- Blogger

- Amazon

- Yahoo Mail

- Gmail

- AOL

- Newsvine

- HackerNews

- Evernote

- MySpace

- Mail.ru

- Viadeo

- Line

- Comments

- Yummly

- SMS

- Viber

- Telegram

- Subscribe

- Skype

- Facebook Messenger

- Kakao

- LiveJournal

- Yammer

- Edgar

- Fintel

- Mix

- Instapaper

- Copy Link

Posted: 19 August 2016 | Sue Chan (Head of UITP Asia Pacific) | No comments yet

Asia – as the world’s largest and most populated continent – shows great diversity in every aspect: economic condition, cultural practice, infrastructure development, institutional framework, and significantly, development of public transport. With ever-increasing globalisation, a sustainable and efficient public transport system is becoming the lifeline for many cities. Each city has its own public transport development challenges, but in the hustle and bustle of Asia some cities have turned these challenges into great opportunities to boost the economy, enhance communities and create a sustainable environment for its citizens.

The Asia region, currently home to 17 megacities, is expected to be occupied by an unprecedented total of 22 megacities by 2030. This rapid growth puts the spotlight on many urban challenges, such as congestion management, sustainable transport solutions, and the use of technology to improve mobility in densely populated cities. Some authorities have embarked on the journey of creating sustainable transport systems, such as Tokyo, Hong Kong and Seoul, and even looking forward to the next challenge to achieve greener integrated systems, such as Singapore and Taipei. Some cities such as Beijing and Kuala Lumpur have ambitious master plans for public transport reform, and are in a race against the clock with increasing urbanisation and motorisation rates. On the other end of the spectrum, developing cities like Jakarta and Manila are in the infancy stages of public transport and are heavily relying on informal means of public transport. Finally, the less developed countries such as Laos and Cambodia have experienced decades of political instability and have not had an opportunity to invest in their public transport networks.

In Asian cities rapid urbanisation and rising incomes are leading to a doubling of the motor fleet every five to seven years. One fifth of transport emissions are from developing cities in Asia. In Bangkok, for instance, the cost of traffic congestion is about 6% of GDP. Road crashes cost Asia Developing Bank’s developing member countries USD$96 billion annually1. Public transport is important for improving sustainable mobility in urban areas and, in general, Asian countries have considered it the right approach to encourage low-carbon growth in cities. Cities with sustainable transport systems, such as Tokyo, Seoul, Hong Kong and Singapore have a high share of public transport – some as high as 80% of public transport – as well as walking and cycling. Other emerging cities like Kuala Lumpur (Malaysia), Beijing, Shanghai and Shenzhen (China) are also aggressively promoting the use of public transport services.

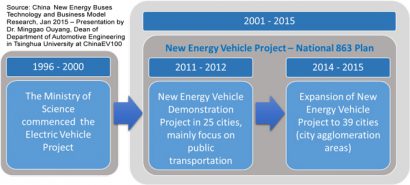

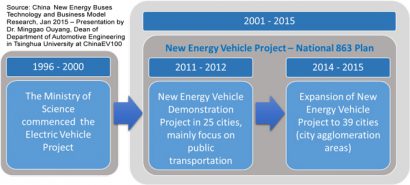

Figure 1: Development of Chinese electric and hybrid electric vehicles

Like many other regions, Asia faces a diversity of challenges as well as opportunities in public transport. Each city is working hard to develop policies and solutions to ensure their city is developing in a sustainable manner.

Importance of financial sustainability

Financial sustainability of mass transit systems is crucial to every authority and operator when planning public transport systems, especially with metro systems which require heavy capital investment to build as well as operate. It is therefore essential to look at additional revenue sources beyond fares, in order to sustain such systems. Hong Kong is often considered a success story for encouraging the growth of public transport. The city’s transport strategy is strongly associated with sustainable development with a strong focus on better integration of transport and land use planning, as well as on the use of railways as the back-bone of its passenger transport system. With a land area of only 1,105km2 and a population of more than seven million, Hong Kong has limited space to achieve sustainable development.

MTR Corporate Limited (MTR), the rail operator in Hong Kong, has developed the Rail + Property Model whereby the government grants ‘Land Development Right’ of sites comprehensively planned by MTR for new railways and, in return, MTR pays a land premium to the government on a ‘Greenfield – No Railway’ basis. MTR also partners with property developers to develop the area around the stations in order to encourage community growth. The financial incentive for MTR is to benefit from the rising property value, allowing the profits to fund railway construction and running costs. The community benefits from an affordable world-class railway service and high quality sustainable developments along the railway. It is a win-win situation as the government does not have the burden of subsidisation and also receives significant land premium and higher value for its shareholding (approximately 76%2). This model has become one of the best examples of ‘value capture’ to finance railway investments. It encouraged approximately 41% of all trips to be made on railway, equivalent to

carrying approximately 4.7 million passenger trips per day in 20153.

Private vehicle ownership problem

The undesirable connotation of public transport in Asia, especially in developing cities, poses a challenge for the authorities and operators to consider and revolutionise their policies. As disposable income levels increase, there is a higher tendency to shift from public modes to private motor vehicles. Public transport is perceived merely as an option for people who cannot afford their own vehicle. In addition, there is a conflict of interest where some governments have subsidy schemes for the automobile industries and/or fuel costs in order to encourage economic growth, which has created further barriers on the promotion of public transport.

New Energy BRT in Zhengzhou, China

Over the years, Malaysia has flourished into one of the fastest growing countries in Southeast Asia with an increase in population from 28 million in 2009 to 30 million in 2014. Presently, public transport only accounts for 20% of all journeys in urban areas. This is partly due to the government’s large subsidies to the Malaysian auto industry, especially for the home brand Proton. The Prime Minister recognised the need for a national reform on public transport in 2010, where the Land Public Transport Commission (SPAD) was set up to bring the functions of policy planning and regulating all aspects of land public transport under one roof.

In order to mitigate negative externalities of increased mobility demand, the Greater Kuala Lumpur/Klang Valley Land Public Transport (LPT) Master Plan has set two main goals for 2030:

- To achieve 40% mode share for LPT in the Central of the Greater KL/Klang Valley

- To achieve 80% of population living within 400m of LPT in the Greater KL/Klang Valley.

The public transport reform in Malaysia brought new light to Malaysia’s public transport system with clear objectives and policies. Under this reform the modal share of public transport in urban areas rose from 19.6% in 2012 to 20.8% in 2013. It further aided the business case for

Prasarana Malaysia Berhad, the asset owner and multi-modal operator of three Malaysian cities, to continue investing in its infrastructure and services. The operator embarked on a series of initiatives to improve existing capacity and accessibility of urban rail transportation in Greater KL in order to meet today’s mobility demand and to accommodate future population. This included the extension of two LRT lines, fleet expansion and the appointment of a new operator for a new MRT Sungai Buloh-Kajang Line. Existing urban rail systems in Greater Kuala Lumpur have a daily ridership of 650,000 at present4.

Energising new and existing industry

Since the early-1990s the automotive industry has been considered as one of the pillar industries of the national economy in China. The Chinese government has declared a policy that the development of the automotive industry should rely on the domestic market for private cars. In 2015 23.9 million new cars were registered in China, taking car ownership up to 172 million. As of the end of 2015 vehicle ownership had reached 279 million with over 61% being cars, marking a transition from motorcycles to automobiles as a major means of motor transport. The automotive industrial policy has undoubtedly driven the economic growth but the costs of the growth are the progressively severe congestion and pollution problems.

In recent years, shifting modal share from private car to public transport has become one of the main highlights on China’s sustainable transport policy. As the main carrier in urban passenger transport, the number of buses is growing during city urbanisation. Buses, as one of the major sources of air pollution, have directly contributed to the rising figures of PM2.5. Electrification is therefore necessary for a cleaner environment.

In 2011-2012, the ‘New Energy Vehicle Demonstration Project of Public Transportation’ was implemented in 25 cities in China. The project includes 27,432 vehicles, 53% are buses, of which 83% were hybrid and 17% full electric. This represented a breakthrough for hybrid electric technology in China. In 2015 over 570,000 buses were sold by all Chinese manufacturers, including 58,484 units of e-buses to all markets including overseas markets.

With the National Policy’s support, Chinese manufacturers are encouraged to invest in innovation, practiced solutions and business models under the National standards. This is consistent with one of the main objectives of the newly released ‘13th Five-Year Transportation Development Planning (2016-2020)’, targeted at raising the mode share of public transport to 40% in megacities and metropolis, 30% in big cities and 20% in medium and small cities by 20205, and to support the development of integrated transportation hubs, ITS and clean energy buses. By 2020 it aims to increase the number of new energy buses to 200,000, with the acceleration of the construction of new energy vehicle charging equipment.

The monopoly, oligopoly or competitive public transport markets debate

The debate on the market structure of the public transport market is also posing controversy – what is the best balance between an optimal social service and ensuring economic benefits? Countries such as the Philippines and Indonesia have bus systems that are owned and operated by a large number of small operators, whereas many cities in China have a single publicly owned entity that provides all transport services. Having a large number of small operators allows for low-cost services, but the quality is poor due to severe competition; dangerous driving practices; pollution; and duplicate services on profitable routes and lack of service on non-profitable routes. In contrast, single publicly owned entities may offer higher quality of service but with high costs and insufficient services.

|

Table 1: JRE’s ‘joyful trains’ |

|

|

Type of Trains |

Theme |

|

Toreiyu Tsubasa |

Hot spring |

|

Koshino Shu Kura |

“Sake” (Japanese wine) |

|

Tohoku Emotion |

Restaurant |

|

Steam Locomotive Ginga |

Galaxy |

|

POKÉMON with YOU Train |

Encourage children |

|

Cruise Train Shiki-Shima (will be ready in 2017) |

Luxury |

There is increasing recognition that the best industry structure falls somewhere between the two. Singapore’s new model has now become the benchmark – having a single public entity that plans the network and determines the quality of service, with a small number of private operators providing services under structured contracts, allows a balance of good public catering of needs with the operational efficiency of the private sector.

Monorail in Kuala Lumpur, Malaysia

In the 1960s the Singapore bus landscape was unregulated with many private bus companies competing for profitable routes leaving many areas underserviced. All bus companies were then merged in 1973 to create Singapore Bus Service (SBS) in order to improve service reliability, staff management and fleet maintenance. Eventually, bus services came under a duopoly with SBS Transit (renamed from SBST) having a majority share of the bus network with Singapore MRT (SMRT) operating most of the rail lines. With increasing expectations from bus users, Singapore embarked on a new contracting model in 2015 – a new model that aims to provide greater competition in the bus industry, making public bus services more responsive to changes in ridership, commuter travel demand and expectations. Under the new contracting model the following is now in place:

- The Government determines the routes and service standards

- Bus operators are contracted via competitive tendering for the right to operate

- Bus operators pay service fees to operate, while fare revenue is retained by government

- The Government owns all bus infrastructure such as depots, work – shops, buses and systems (e.g. fleet management and ticketing)

- Market entry barriers have been lowered in order to attract more bus operators.

This regulatory model helps keep a balance between the public transport operator market share and its competition.

Increased competition leads to enhanced public transport services

Competition in the transport industry is increasingly intense, especially for regional public transport operators. One of the biggest challenges for Japan is the decreasing trend in the use of regional rail which is competing with regional airlines, private vehicles and private coaches. In the last few years East Japan Railway Company (JRE) has set a target to create new demand for the following market segments:

- Leisure trips

- Trips for senior citizens

- Trips for rural areas.

‘Joyful Trains’ have been created by JRE that aim to make riding fun and push the limits on train design. This initiative has developed a new market segment and given new meaning to public transport by encouraging users to board just for the ‘ride’ itself, rather than as a means of transport. This initiative not only intends to create new demand for regional travel, but also revitalise local communities, such as hotels, restaurants and souvenir shops in the rural areas. For a few selected lines the trains have been converted to present the themes shown in Table 1.

Commuters always expect more!

Strive to continuously improve and provide a greener public transport system

As with many services, once the city has reached a level of stability in public transport services, customers start to have higher expectations. On top of the efforts on enhancing the public transport, Asian cities with more mature and comprehensive public transport networks such as Singapore, Tokyo, Hong Kong and Taipei have also begun focusing on ‘Active Mobility’ with the aim of closing the first-mile and last-mile gap.

Singapore has been introducing its ‘Walk2Ride’ Scheme, ‘Silver Zone’, ‘National Cycling Plan’ and various infrastructure improvements to support active mobility. It is the government’s goal to encourage walking, cycling and use of public transport to become a way of life for Singaporeans. The Ministry of Transport aims to have three in four commuters choosing public transport as their main mode of travel by 2030, with the proportion rising to 85% by the 2050s. The government

will invest a projected S$36 billion in public transport expenditure over the next five years to make the ‘car-lite’ vision a reality. The Land Transport Authority has set up an Active Mobility Unit to improve walking and cycling connections – particularly to train stations and bus stops – in order to address ‘First and Last Mile’ connectivity, and has also invested in on-demand and point-to-point mobility options, new technologies and new business models to serve ageing demographics

and maintain sustainability.

Taipei is another Asian city that is concerned about public transport connectivity and being an eco-friendly city. The market share of public transport in Taipei Metropolitan (Taipei and New Taipei) in 2015 was 58%. It has been the vision of Taipei in recent years to promote green transport and to grow its market share to 70% and the share of bicycleuse from the current 5% to 12% by 2020. The Department of Transport of Taipei developed the ‘Bike-Bus-Metro-Walk (BBMW) Green Transportation System’ plan to meet the future transportation demand. Under the BBMW scheme the government’s goals are to improve bus systems by providing more exclusive bus lanes; creating a barrier free transport environment by introducing low-floor bus and barrierfree taxis; expanding urban bicycle networks and dedicated lanes as well as public bike rental stations in conjunction with additional pedestrian facilities. One of the successful outcomes of BBMW was the launch of YouBike in 2009 as one of the steps in re-humanising the cityscape. This bike sharing scheme has proven its success with a grand total of 200 YouBike stations and more than 6,500 operating public rental bicycles in service. This has transformed Taipei into a cycling city and YouBike is being introduced to other Taiwanese cities, such as Taichung and Taoyuan.

Still more challenges and opportunities to realise

From cities with sophisticated and world-class public transport, to cities with minimal or non-existent multimodal public transport planning, each city in Asia faces unique, yet common, problems. These challenges also present many opportunities for the public transport industry. For example, ADB is investing USD$0.6 million to support the development of an efficient, integrated and sustainable public transport system for Ho Chi Minh City (HCMC) in Vietnam and recently approved a USD$0.5 million deal to finance a plan for Mongolia to provide policy and technical advisory assistance for ITS development. With a population of over 4.7 billion – equivalent to approximately 60% of the world’s population – Asia plays a crucial role in exploring opportunities in planning, implementing and promoting sustainable transport. Massive investment in public transport infrastructure is therefore required in order to make its cities better places to live, work and play.

Organised by UITP and the Singapore Land Transport Authority (LTA) with the theme of ‘Innovating Transport for liveable cities’, The Singapore International Transport Congress and Exhibition (SITCE) to be held in Singapore from 19-21 October 2016 aims to specifically address the public transport issues and provide innovative solutions needed to achieve the above objectives.

Acknowledgement

The author would like to thank Ms. Gayang Ho from UITP Asia Pacific for her assistance and contribution in the preparation of this article.

References

- http://blogs.adb.org/blog/time-scale-sustainable-transport-asia-and-pacific

- Presentation by James Hor, Head of Property Development, MTR Corporation at the UITP Asia Pacific Assembly in Kuala Lumpur, May 2016

- www.td.gov.hk/en/transport_in_hong_kong/public_transport/railways/index_t.html

- Presentation by Dato’ Azmi Abdul Aziz, President & Group CEO, Prasarana Malaysia Berhad at the UITP Asia Pacific Assembly in Kuala Lumpur, May 2016

- Note: Megacity: city with >10 million permanent residents; Metropolis: city with 5-10 million permanent residents; Big city: city with 1-5 million permanent residents; medium city: city with 0.5-1 million permanent residents; small city: city with <0.5 million permanent residents

About the author

Sue Chan is the Head of UITP Asia Pacific. She has been working in the traffic and transportation field for nearly 20 years, specialising in transport planning, strategy and policy. She was the Director for several transport and engineering consulting firms leading their Hong Kong and China offices. Throughout her career Sue has developed good connections with major transportation operators, transportation related government authorities, international institutions and universities in Asia, particularly in Hong Kong and China. She holds a Master of Arts Degree in Transport Policy and Planning from The University of Hong Kong and a Bachelor Degree in Economics from Macquarie University in Sydney, Australia. She is also a Chartered Member of the Chartered Institute of Logistics & Transport (CMILT).

Related topics

Business Models, Multimodality, Sustainable Urban Transport

Issue

Issue 4 2016

Related cities

China, Malaysia, Singapore, South-East Asia

Related people

Sue Chan